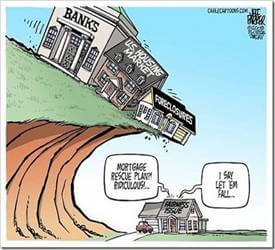

Although the plan was touted as providing much needed help to between 7 and 9 million eligible homeowners, very few citizens have actually been able to obtain a renegotiated loan under the program. Although the government is not releasing detailed statistics, it has announced that 200,000 modifications have been offered to date, but admits that only “tens of thousand” of loan modifications have actually been approved under the program. That’s not even one percent of the stated goal, a miserable record indeed! What happened?

Banks Don’t Really Want to Help

None of this is surprising news to the Consumer Warning Network. You can read our many stories about the loan modification problem (here, here and here). Our research over the past two years shows the notion that banks want to help homeowners modify loans to avoid foreclosure is simply a myth. One that’s been nurtured by these companies, despite the facts that stand in direct conflict.

Complaints to CWN continue unabated from homeowners unable to get their lenders to work with them. Everyone tells the same story. “I’ve tried for months and months to get my lender to talk to me about renegotiating my loan so we both can avoid foreclosure, but all I get is either a dial tone or a big run-around.”

The Numbers Don’t Lie

The Federal Reserve Board of Boston has shed light on this problem with a new economic study looking into the problem of infrequent loan modifications. The study concludes that “fewer than 3 percent of the seriously delinquent borrowers in our sample received a concessionary modification in the year following the first serious delinquency.” So, despite the legislative attempts to aid homeowners with troubled loans, only a very few are getting actual relief through a loan modification.

The leading culprit for the lack of renegotiated mortgages has been the argument that many mortgages are securitized (that is, split up among many investors in packaged mortgage backed securities). This supposedly limits the ability of lenders to engage in meaningful negotiations, as they are afraid of incurring the wrath of investors. In other words, they blame the investor for not letting them do loan modifications. How convenient to have a faceless, nameless “investor” to take the fall, but not so fast.

So Much for Blaming the Investor

The new study, however, shoots down that explanation. It turns out that the lack of loan modifications among securitized loans is no greater than the lack of modifications among loans owned by a single mortgage servicer, so-called “portfolio loans.” Securitization is not the problem.

So what is the problem? Well, surprise, surprise, it’s money. The study found three main reasons for the lack of interest among lenders to help delinquent borrowers through renegotiation, rather than foreclosing. All three reasons are based on the simple fact that lenders expect to recover more from foreclosure than from a modified loan.

1. Servicers are reimbursed for many expenses incurred in the foreclosure process (appraisal fees, title insurance, etc.). Since the servicer often owns the appraisal and title insurance companies as subsidiaries, the property value becomes a piggy bank that the servicer can dip into while the foreclosure process drags on (see our CWN story on this problem). The New York Times just published a similar article on this same phenomenon.

2. Lenders are faced with the fact that many renegotiated loans end up in default anyway a few months later. The new study shows that a modified, renegotiated mortgage ends up re-defaulting within the next six months about 40-50 percent of the time. That means the lender realizes that about half the time all of its efforts at withholding foreclosure and engaging in renegotiations is wasted. And with falling housing values, it means if the loan ends up back in foreclosure, the bank is looking at a home that is worth even less than it would have been had it foreclosed the first time, instead of renegotiating.

3. Surprisingly, the new study found yet another reason why renegotiations make no sense to the lender. The study showed that about 30 percent of delinquent loans end up “self curing.” That means the loan is made current again by the borrower without any intervention by the lender. So again, when faced with a delinquent loan, the lender knows that there is a 30 percent chance it will need to do nothing, and that any renegotiation effort will be needless.

The Odds Are Against Homeowners

With these odds, it’s no wonder that banks show little interest in engaging in renegotiation of loan terms to avoid foreclosure. After all, what’s in it for the bank if it’s better off in foreclosure?

But wait a minute, you may say. What about all of the taxpayer money the lenders took, because they were in so much trouble? They’ve taken care of themselves through our bailout money, but there’s little chance they will ever act just a little bit in our interests instead of their own.

So we’re left with plenty of bailouts for the financial institutions, and useless band-aids for the homeowners. The “Making Home Affordable” program is a big bust. Offering an “incentive” of $1,000 to servicers to modify a delinquent loan is laughable. Sorry folks, there’s just more money in it for banks to foreclose than there is to help the homeowner.

Again we ask – where’s the outrage?

Leave a Reply