Financially Strapped? There’s Help

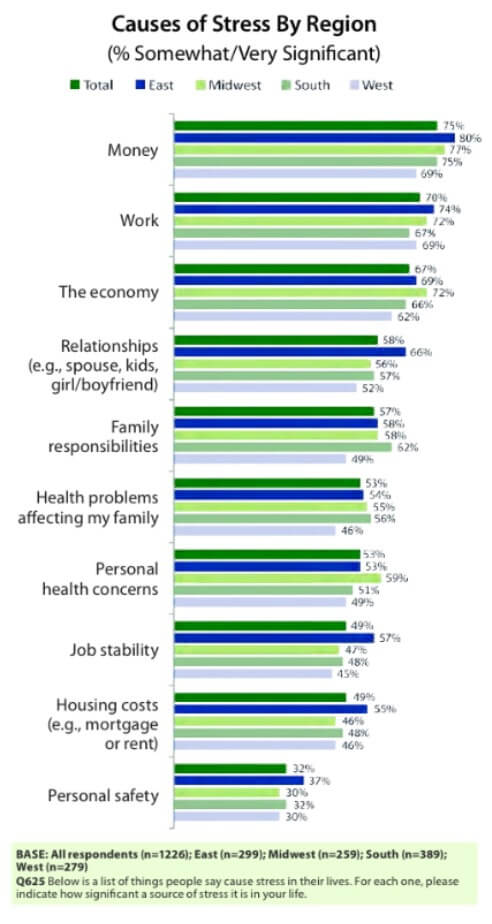

80% of Americans on the East Coast identify money as a significant source of stress in their lives, according to the 2011 American Psychological Association, Stress in America Survey. And, while the economy, housing market, and job markets remain significant concerns for many, personal finances remain the most common concern for Americans.

To a large extent, our lives revolve around money; it determines our housing, our schools, our clothing, our meals, our self-care, and our entertainment. It is closely connected to our education, our employment, and, to some extent, our identity. It is no wonder so many Americans report financial concerns.

Financial stress is often overlooked and dismissed as an insignificant, common experience; however, worries about money can have very significant effects on our lives, including our daily functioning, interpersonal relationships, physical health, and emotional well-being.

Stress that is acute or chronic may manifest itself physically, emotionally, and/or behaviorally. We may then find ourselves trapped in a loop of worry, intense emotion, and a lack of ability to take action to successfully manage those feelings or resolve that which is stressful.

Personal Impact

Effects of Stress

When we are faced with stressors, we experience physiological, emotional, and cognitive arousal. Activating chemicals, such as endorphins, cortisol, and adrenalin, are released in order to help up rise to the challenge of meeting the demands of these stressors in order to effectively manage them and reduce the tension or distress we are experiencing. This is called the flight or fight response. When the stressor(s) are perceived as too great for us to manage or cope effectively, we can feel overwhelmed.

To complicate matters, in addition to managing our own physical, emotional, and behavioral effects of stress, we continue to be responsible for our homes, our work, and our families.

Financial stress can create worry about how your financial situation will affect you and your family’s lifestyle, emotional wellbeing, and future plans. Financial and legal consultants may assist in developing financial plans to protect your assets and secure your future; however, financial worry can be overwhelming. Help yourself cope with some of these strategies.

Tips for Managing Personal Stress

Addressing Stress and Anxiety

✦ Be aware of your unhelpful thoughts and modify unrealistic thinking. We all have moments wherein we unintentionally increase or maintain our own worry by thinking unhelpful thoughts. These thoughts are often unrealistic, inaccurate, or, to some extent, unreasonable. Identify those thoughts. Think about them and how the affect your feelings and behavior. If they are not helpful, change them to more helpful, adaptive thoughts. For example, beware of thoughts that overgeneralize, are all-or-nothing, in nature, catastrophize, or make negative predictions or judgments without sufficient evidence.

✦ Practice acceptance. Navigating challenging times may result in long-term growth and positive change.

✦ Be in the “now.” Too much worry about what may or may not happen and you will be unable to enjoy the present moment. So, schedule time to plan for what may come, but take in all that is your present moment and enjoy your now.

✦Take a deep breath. Practicing diaphragmatic breathing or other relaxation inducing practice can reduce stress by helping to encourage relaxation.

✦Take a break. Everyone needs a break to restore their focus and well-being. Whether it be a simple change of pace or scenery, enjoying a hobby, or switching “to-do” tasks, breaking from concerted effort can be refreshing

✦Take action. Engage in an activity you enjoy, such as taking a walk, listening to music, or reading. Engage in problem solving. by identifying the causes of distress and considering options for relief.

✦ Practice good self-care. Quality nutrition, sleep, and exercise help relieve stress and maximize health and resiliency.

✦Maintain social and family connections. Social support is a significant factor in resiliency and successful stress management.

Tips for Managing Family Stress

Addressing Finances with Children

When a family is struggling financially, it is challenging for parents to shield their children from their distress.

✦ Pay attention to your child’s level of understanding of your financial situation. Help them to understand in an age appropriate manner and reassure their safety and stability.

✦Model good problem-solving skills, collaborative decision making, and positive thinking.

✦ Be mindful of your own emotional reactions and thoughts; take care not to overreact and consider all viewpoints and options.

✦ Encourage your children to be involved in family decisions such as deciding on fun, low-cost family activities.

✦Maintain consistency in home routines. Structure and familiarity help children to feel safe and secure.

Download the complete PDF from THE CENTER FOR EMOTIONAL HEALTH OF GREATER PHILADELPHIA, LLC

Leave a Reply